Festina Lente Fund

ad Augusta per Angusta

Investing can be a complicated and highly stressful process.

If you invest on your own initiative, it will be up to you to select your investments, keep track of their performance and make any changes to your investment strategy as circumstances require. It may be useful to seek professional assistance while you are in the process of building up your portfolio, but you should in any case be aware that the portfolio creation and monitoring process may be time-consuming.

Selecting an investment involves achieving the right balance between risk and potential returns. As a general rule, if you opt for a low level of risk the returns will be limited, while if the risk level is higher there is greater potential for obtaining more attractive and profitable returns.

The exact alternative of investing is to keep large sums of money in cash. In this case, while the short term risk is low, it will become significantly higher in the long term, as inflation tends to erode the purchasing power of your money and gradually leads to the destruction of your initial wealth.

There are various investment options, including shares, bonds, properties, sector, growth and value investments, indexed-linked securities and investments in the monetary market. Each of these classes has different properties, but, unlike what happens when you simply hold on to your cash, their values may rise and fall.

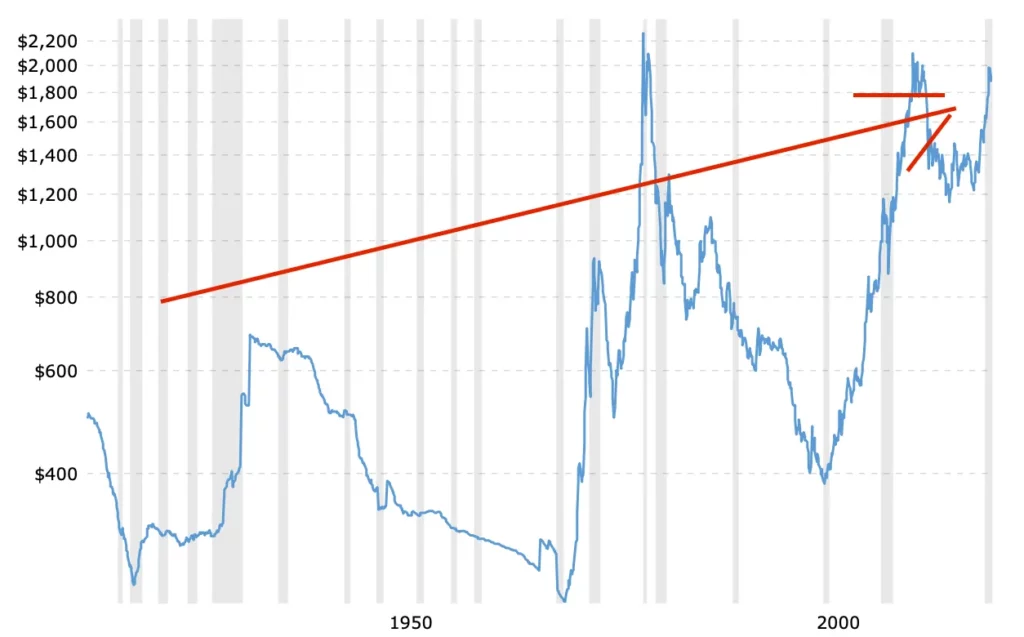

History has shown that, in the long term, the share market – representing the shares in single companies – tends in general to be the most volatile of these classes, but is also the one which offers the best overall returns. The ability to combine shares with other asset classes may reduce this volatility in the short term, while continuing to offer reasonable levels of return.

The main investment classes are:

• Shares

Investments concentrated in the appreciation of capital through a diversified portfolio of companies which have demonstrated above average growth

• Fixed interest securities

Bond investments generating monthly income, including those in government and company securities, as well as other debt instruments

• Property

Investments in the real estate sector

• Cash

Investments in the foreign exchange market

• Sectorial

Investments in companies conducting business in a specific sector of the economy

• Investments in growth

Investments in undervalued companies (usually long term investments)

• Index-linked investments

Programmes which enable investors to keep track of an overall market by building up a portfolio to be combined with or which shadows a market index

• Crypto Currencies Investing in BTC

Master Node Validator - Passive Gains

Today it is possible, among other options, to consider investments with cryptocurrencies as well, for immediate gains and

recurring passive gains forever.

Within the crypto ecosystem in Decentralized Finance (DEFI), it is also very promising to become a Masternode Validator.

Interoperability between different Blockchains, enables more efficient, cost-effective and intuitive exchanges and makes transactions easier for the market.

For those who are already in possession of Crypto currencies, one can do the analysis for using their Wallet as an Asset as well.

This is, therefore, the right time for investments in volatile ASSETS such as cryptocurrencies (Bitcoin and other Crypto), the current market downturn can pay off greatly in the future.

About Us

We are an investment fund that employs 20 highly motivated professionals with over 15 years of experience in the financial sector.

The fund pool investors’ money and places the resulting capital in a variety of investments, to create diversification through the management of a multitude of stocks and different asset classes. The benefits of diversifying investmrnts are that your interests are spread over a number of holdings rather than beingin a single company, industry or other entity, thus minimising potential losses.

By reducing the correlation to which your placement are subject, you also reduce the risk of all collapsing at the same time.

Mission

LET'S BUILD A THRIVING FUTURE TOGETHER

Our ambition is to become a global leader offering the most effective, unique and innovative investment services which not only protect our clients’ capital by avoiding value losses but also provide them with returns that meet their expectations.

Vision

Our vision is to become a global leader offering highly effective and unique investment services and fully safeguard our clients’ savings. Our policy is to prevent clients from losing their capital.